April is Financial Literacy Month. According to statistics, “Americans carry more than $2 trillion in consumer debt and 30 percent of consumers report having no extra cash; making it impossible to escape the burden of living paycheck to paycheck.” (quote from previous link) Financial Peace University, Dave Ramsey’s program/class, is a well-respected system for learning to better manage your finances.

Many people choose to enroll in a live class in their areas. This is actually recommended, I think, if it’s something you’re able to do, because the accountability is good for inspiring lasting change in spending behaviors. If, however, there is not a class available, or you aren’t able to make it (due to scheduling, little ones at home, etc.), you can purchase the course yourself and complete it at home or with a small group of friends. The folks at Dave Ramsey were gracious enough to provide us with a FPU set so we could check it out and let you know what we think of it.

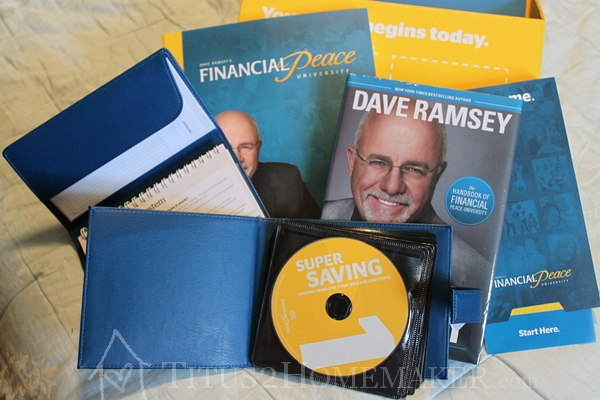

The kit comes with everything you see above: there’s a nice box, containing Dave Ramsey’s Complete Guide to Money, the course workbook, a booklet full of the course lessons on CD, the envelope system, a progress poster (not visible in the image, inside the box), a folder for your budget forms (also inside the box), and that little box you see at the far right, shown open below:

You can see it holds some basic tools, like a pencil, sharpener, and eraser. It also has that membership ID you see in the upper right, which allows you to register on the website for some extras, like a couple of bonus lessons.

Lessons cover: Super Saving (the famous “baby steps”), Relating with Money, Cash Flow Planning (the “nuts and bolts of budgeting”), Dumping Debt, Buyer Beware (how to avoid buying traps), the Role of Insurance, Retirement and College Planning, Real Estate and Mortgages, and The Great Misunderstanding (about the power of giving).

This is a very thorough program, providing all the necessary tools in one package.

Our Thoughts

Now, I have to tell you that I know a number of people who have gone through this system and rave about it. I know dozens of people who have used it to dig out from under huge debts, who paid for their homes in cash, etc. I have not heard a single person say that they have used this program and not liked it. And I love Dave Ramsey’s tools for teaching our kids! (Even the kids get excited about them!)

However, my husband and I have struggled every time we’ve tried to take a look at any of Dave’s products “for grownups.” We read one of his older books (Total Money Makeover, I think, but it was an older edition) and felt that the numbers (costs, etc.) were just not realistic, and would never work for us. Financial Peace University has just recently been completely updated, and we were hoping that it would reflect the recent changes in the economy and, thus, that we would find it more realistic and workable for us.

Unfortunately, we have not found that to be the case.

I don’t feel like our income is that low (‘though we’re aware that’s it’s naturally lower than those of most dual-income households), but when we compare our costs to those I find addressed by frugal living experts, the only explanation we can come up with is that our income must be pretty small compared to the cost of living in our area, as compared to those with these amazing success stories we read.

As my husband points out, it’s easy for them to show that you can make big changes, if all of the examples are of folks who have lots of room for change! To give you just one example, Dave Ramsey’s Complete Guide to Money includes a testimonial from a woman who, together with her husband, paid off “$120,000 in debt” in twenty months. We don’t make $120,000 in twenty months – if every single penny of our income went to debts, this is still not something that would be humanly possible, and that’s not taking into account the fact that we do actually have expenses our income needs to cover. (We don’t have $120,000 in debt either, thankfully! But hopefully you get the point.)

To show the discrepancy another way, consider his chart of expenses as percentage of income. Worksheet 6 (also in Dave Ramsey’s Complete Guide to Money) shows recommended percentages of your income to allocate to various budget categories. Now, he does acknowledge that these will vary, pointing out that “for example, if you have a high income, the percentage that is spent on food will be much lower than someone who earns half that.” But even at that, we found these to be astronomically far off the mark for our reality.

Utilities are recommended at 5-10%. I assume that utilities would include water, sewer, and electric (or gas, or whatever provides the power/heat/etc. for your home). Just at a glance, I’m not sure whether telephone service is included in this category or not. I don’t pay the bills; my husband does, so my idea of how much we pay each month is vague, rather than specific. But even assuming that ‘phone service is not part of utilities, I’m pretty sure our utilities are more than 10%. If you add in telephone service, they’re even higher. These are not expenses we have a good deal of control over!

Now, I point all that out not to complain about our income – or even about the course – but simply to point out that it’s not necessarily the panacea that it appears it is for everybody. We know a good number of people who live in lower-cost areas or have a higher income (or both), who have found it immensely useful. And, frankly, I think it would be fantastic to take our children through in their youth, so they can get started on a better foot. But if your income is very, very close to your expenses, don’t necessarily expect miracles, either.

Take a Step

Now, I’m curious. Baby step #1 is to put $1,000 in a starter emergency fund (or $500 if your income is under $20,000/year). The idea is that then you will have this to fall back on when things come up (such as your car, which is your only source of transportation, breaks down and needs repairs) while you’re completing the other steps, so these emergencies don’t throw you off course. (You’ll build a larger, more long-term emergency fund in a later step.) Dave says that “most people can come up with $1,000 in a month if they make it a priority.” This is actually one of the reasons hubby balks at FPU. There is no way we can realistically can come up with $1,000 in one month (that isn’t paying for something, like the utilities or for us to eat) even scrimping and squeezing. But how ’bout you? If you are completely honest, could you realistically set aside $1,000 over the coming month? If so (and assuming you haven’t), why haven’t you? Seriously consider doing so this month, to get yourself on course for less stressful money management. (And if you couldn’t, please tell me it’s not just us!)

Disclosure: DaveRamsey.com provided us with a Financial Peace University course to facilitate this review. As always, all opinions expressed here are entirely my own (and those of other household members).

Leave a Reply